4 New Hints For Deciding On An RSI Divergence Strategy?

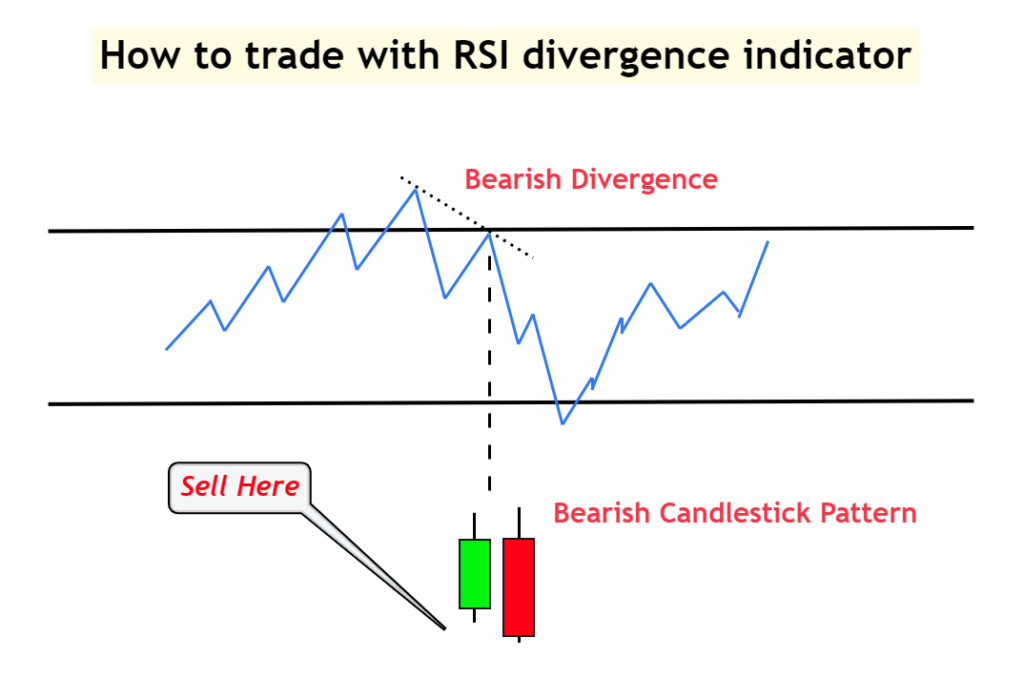

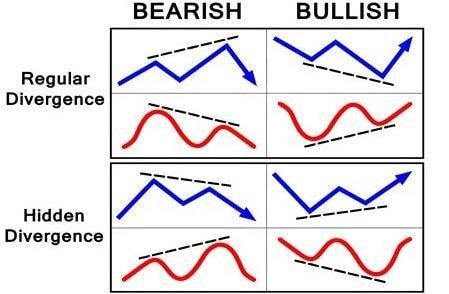

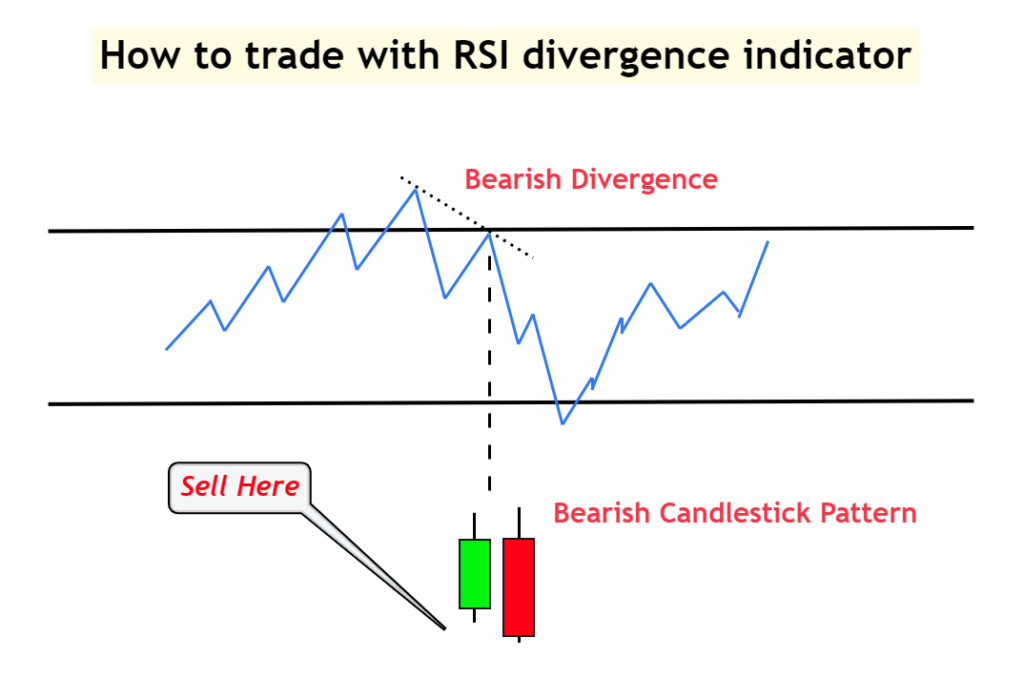

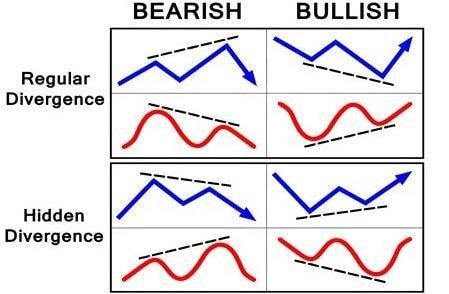

Okay, let's begin by asking the obvious query and explore what is RSI Divergence is and what trading clues we can get from it. The Divergence happens on your chart when the price action as well as the RSI indicator are out of the sync. The RSI indicator could make lower lows during a downtrend, but the price action is able to make lower lows. The divergence is when the indicator isn't in agreement with the price movement. When this happens it is crucial to keep an eye on the market. The chart clearly shows bullish RSI divigence and bearish RSI divigence. As such, the price action reversed immediately after each RSI Divergence signal. Let's talk about one last topic before moving on to the thrilling topic. Read the top rated forex backtest software for blog info including funded forex account, automated scalping strategies, auto forex, apex crypto trading, fx time, free forex trading platform, meta trader 5, forex expert, ig forex broker, binance auto sell, and more.

What Is The Best Way To Analyze The Divergence In Rsi?

We use the RSI indicator to identify trend reversals, it is very important to identify the correct trend reversal to do that, first we need to have a trending market, then we utilize RSI divergence to determine the weaknesses in the current trend and then we can use this information to spot the trend reversal in the right time.

How Do You Recognize Rsi Divergence When Trading Forex

Both Price Action and RSI indicators have both reached higher highs prior to the beginning of the uptrend. This usually indicates that the trend seems solid. The trend ended when Price reached higher highs at the end. However, the RSI indicator was able to reach lower highs. This indicates the chart is one to watch. This is why we need be aware of the market. The indicator and price actions are not in sync and could be a sign of an RSI Divergence. The RSI divergence in this case indicates a bearish trend rotation. Check out the graph above and note what transpired following the RSI divergence. Look at the RSI divergence is extremely accurate when it comes to finding trends that are reversing. The real question is what can you do to spot the trend reversal? Let's discuss four strategies for trade entry which provide higher probability entry signals when combined RSI divergence. See the top rated crypto trading backtesting for blog tips including sofi robo investing, best crypto swap exchange, fx forex, top forex brokers with high leverage, best broker for automated trading, tradingbot, fxcm leverage, alpari minimum deposit, best crypto app for beginners, gps forex robot, and more.

Tip #1 – Combining RSI Divergence & the Triangle Pattern

Triangle chart pattern has two variants. One is an Ascending triangle pattern which is works as a reversal pattern in an downtrend. The second one is the descending triangle pattern that can be used as a reversal in an uptrend market. Let's look closer at the forex chart to observe the downwards-facing circle pattern. The market was in an uptrend, and it eventually began to decrease. RSI is also a sign of divergence. These indicators reveal the weak points in this uptrend. Now, we can discern that the uptrend is losing momentum. As a result, the price formed an upward triangle. This is a confirmation of that the reverse is happening. It is now time to execute the short trade. The methods used to break out for this trade were exactly the identical to the ones used previously mentioned. We'll now look at the third trade entry method. This time , we're going to pair trend structure with RSI divergence. Let's examine how to trade RSI diversgence in the event that the trend is changing. View the most popular crypto trading for site advice including coinbase platform, kryll coin, coinbase trading fees, etoro coin list, daily forex signals, prop firm ea, automated copy trading, mt4 forex, binance trading automation, crypto demo, and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI Divergence can help forex traders spot market Reversals. So what if we combined RSI divergence with other reversal factors like the Head and shoulders pattern? This could increase the chance of making a trades, which is fantastic isn't it? Let's look at how to make trades more profitable by combining RSI diversence along with the Head and Shoulders pattern. Related to: How to Trade the Head and Shoulders Pattern in Forex. A Reversal Trading Strategy. We must ensure that the market is in a favorable state before we consider trade entry. If we are looking to witness a trend change, it is best to have a strong market. Below is the chart. Check out the best position sizing calculator for blog examples including ecn broker, binance fees per trade, start crypto trading, algotrader 4.0, forex graphs, computerized stock trading, whitebit crypto, automated trading made simple, hitbtc fees, fortrade pro trader, and more.

Tip #3 – Combining RSI Divergence and the Trend Structure

The trend is our friend. Trends are our friends, as long as it's trending. However, we need to trade in the direction of its movement. This is what professionals tell us. But, the trend won't last for a long time. Somewhere, it will reverse. Let's look at trend structure and RSI divergence to determine how we can identify those reversals early. We all know that uptrends are forming higher highs, while downtrends form lower lows. In light of that Let's take a close review of the chart below. The left-hand side of the chart shows a downtrend, with a series a lows and highs. Next, have a take a look at the RSI divergence marked in the chart (Red Line). The RSI creates high lows. Price action creates lows. What does this mean? Despite the market generating low RSI This means that the current downtrend is losing its momentum. View the most popular trading with divergence for blog tips including automated trading signals, metatrader 4 online, rsi divergence entry, forex trading education, options auto trading, apex crypto trading, hycm broker, best online crypto exchange, interactive brokers automated trading, forex demo account metatrader 4, and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

Double top, also referred to as double bottom, is a reverse-looking pattern that occurs after an extended movement or following a trend. Double tops are formed when the first top will be formed when the price reaches the level at which it cannot be broken. When it reaches that level then the price will move lower , but will then bounce back to test the previous level again. DOUBLE TOPs happen when the price bounces off this threshold. Look below for the double top. The double top above demonstrates that both tops were formed after a hefty movement. You will notice that the second one hasn't been able break the top of the previous. This is a sign of an inverse. It's telling investors that they have a hard time moving higher. The double bottom uses the same principles but is carried out in the opposite direction. We employ the breakout trading strategy. In this instance we will sell the trade once the price is below the trigger line. Within one day, our profit was achieved. QUICK EARNINGS. Double bottom is covered by the same strategies for trading. Take a look at the graph below to learn the methods to trade RSI divergence using double bottom.

It is not the ideal trading strategy. There is no one perfect trading strategy. All trading strategies have losses, and these losses are inevitable. While we earn consistent profits with this trading strategy We also employ a strict risk management as well as a swift way to cut the losses. That way we can minimize the drawdown, and can open the way to huge potential for upside. Read more- Great Reasons For Selecting Trade RSI Divergence 5557eaf , Recommended Tips For Picking Trade RSI Divergence and Best Advice For Selecting Trade RSI Divergence.

Okay, let's begin by asking the obvious query and explore what is RSI Divergence is and what trading clues we can get from it. The Divergence happens on your chart when the price action as well as the RSI indicator are out of the sync. The RSI indicator could make lower lows during a downtrend, but the price action is able to make lower lows. The divergence is when the indicator isn't in agreement with the price movement. When this happens it is crucial to keep an eye on the market. The chart clearly shows bullish RSI divigence and bearish RSI divigence. As such, the price action reversed immediately after each RSI Divergence signal. Let's talk about one last topic before moving on to the thrilling topic. Read the top rated forex backtest software for blog info including funded forex account, automated scalping strategies, auto forex, apex crypto trading, fx time, free forex trading platform, meta trader 5, forex expert, ig forex broker, binance auto sell, and more.

What Is The Best Way To Analyze The Divergence In Rsi?

We use the RSI indicator to identify trend reversals, it is very important to identify the correct trend reversal to do that, first we need to have a trending market, then we utilize RSI divergence to determine the weaknesses in the current trend and then we can use this information to spot the trend reversal in the right time.

How Do You Recognize Rsi Divergence When Trading Forex

Both Price Action and RSI indicators have both reached higher highs prior to the beginning of the uptrend. This usually indicates that the trend seems solid. The trend ended when Price reached higher highs at the end. However, the RSI indicator was able to reach lower highs. This indicates the chart is one to watch. This is why we need be aware of the market. The indicator and price actions are not in sync and could be a sign of an RSI Divergence. The RSI divergence in this case indicates a bearish trend rotation. Check out the graph above and note what transpired following the RSI divergence. Look at the RSI divergence is extremely accurate when it comes to finding trends that are reversing. The real question is what can you do to spot the trend reversal? Let's discuss four strategies for trade entry which provide higher probability entry signals when combined RSI divergence. See the top rated crypto trading backtesting for blog tips including sofi robo investing, best crypto swap exchange, fx forex, top forex brokers with high leverage, best broker for automated trading, tradingbot, fxcm leverage, alpari minimum deposit, best crypto app for beginners, gps forex robot, and more.

Tip #1 – Combining RSI Divergence & the Triangle Pattern

Triangle chart pattern has two variants. One is an Ascending triangle pattern which is works as a reversal pattern in an downtrend. The second one is the descending triangle pattern that can be used as a reversal in an uptrend market. Let's look closer at the forex chart to observe the downwards-facing circle pattern. The market was in an uptrend, and it eventually began to decrease. RSI is also a sign of divergence. These indicators reveal the weak points in this uptrend. Now, we can discern that the uptrend is losing momentum. As a result, the price formed an upward triangle. This is a confirmation of that the reverse is happening. It is now time to execute the short trade. The methods used to break out for this trade were exactly the identical to the ones used previously mentioned. We'll now look at the third trade entry method. This time , we're going to pair trend structure with RSI divergence. Let's examine how to trade RSI diversgence in the event that the trend is changing. View the most popular crypto trading for site advice including coinbase platform, kryll coin, coinbase trading fees, etoro coin list, daily forex signals, prop firm ea, automated copy trading, mt4 forex, binance trading automation, crypto demo, and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI Divergence can help forex traders spot market Reversals. So what if we combined RSI divergence with other reversal factors like the Head and shoulders pattern? This could increase the chance of making a trades, which is fantastic isn't it? Let's look at how to make trades more profitable by combining RSI diversence along with the Head and Shoulders pattern. Related to: How to Trade the Head and Shoulders Pattern in Forex. A Reversal Trading Strategy. We must ensure that the market is in a favorable state before we consider trade entry. If we are looking to witness a trend change, it is best to have a strong market. Below is the chart. Check out the best position sizing calculator for blog examples including ecn broker, binance fees per trade, start crypto trading, algotrader 4.0, forex graphs, computerized stock trading, whitebit crypto, automated trading made simple, hitbtc fees, fortrade pro trader, and more.

Tip #3 – Combining RSI Divergence and the Trend Structure

The trend is our friend. Trends are our friends, as long as it's trending. However, we need to trade in the direction of its movement. This is what professionals tell us. But, the trend won't last for a long time. Somewhere, it will reverse. Let's look at trend structure and RSI divergence to determine how we can identify those reversals early. We all know that uptrends are forming higher highs, while downtrends form lower lows. In light of that Let's take a close review of the chart below. The left-hand side of the chart shows a downtrend, with a series a lows and highs. Next, have a take a look at the RSI divergence marked in the chart (Red Line). The RSI creates high lows. Price action creates lows. What does this mean? Despite the market generating low RSI This means that the current downtrend is losing its momentum. View the most popular trading with divergence for blog tips including automated trading signals, metatrader 4 online, rsi divergence entry, forex trading education, options auto trading, apex crypto trading, hycm broker, best online crypto exchange, interactive brokers automated trading, forex demo account metatrader 4, and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

Double top, also referred to as double bottom, is a reverse-looking pattern that occurs after an extended movement or following a trend. Double tops are formed when the first top will be formed when the price reaches the level at which it cannot be broken. When it reaches that level then the price will move lower , but will then bounce back to test the previous level again. DOUBLE TOPs happen when the price bounces off this threshold. Look below for the double top. The double top above demonstrates that both tops were formed after a hefty movement. You will notice that the second one hasn't been able break the top of the previous. This is a sign of an inverse. It's telling investors that they have a hard time moving higher. The double bottom uses the same principles but is carried out in the opposite direction. We employ the breakout trading strategy. In this instance we will sell the trade once the price is below the trigger line. Within one day, our profit was achieved. QUICK EARNINGS. Double bottom is covered by the same strategies for trading. Take a look at the graph below to learn the methods to trade RSI divergence using double bottom.

It is not the ideal trading strategy. There is no one perfect trading strategy. All trading strategies have losses, and these losses are inevitable. While we earn consistent profits with this trading strategy We also employ a strict risk management as well as a swift way to cut the losses. That way we can minimize the drawdown, and can open the way to huge potential for upside. Read more- Great Reasons For Selecting Trade RSI Divergence 5557eaf , Recommended Tips For Picking Trade RSI Divergence and Best Advice For Selecting Trade RSI Divergence.