What Is The Best Way To Deal With Divergence In Trade Using Technical Indicators

Divergence, a term that is used in technical analysis, occurs when the direction of a technical indicator, typically an oscillator (or any other kind of oscillator) differs from the overall trend in price. In other words, the indicator is moving towards the opposing direction to the price. This means that the trend could be changing direction.

What Is The Difference Between Trading And Divergence?

Day traders interpret a shift in direction or direction of an indicator to be a signal that the price is likely to follow. This scenario uses the oscillator as an indicator for price. The reason why divergence is utilized to study the market is that it indicates the slowing or decline in momentum. The momentum of the price will shift often before the price. Imagine a Frisbee being thrown into the strong winds. The frisbee may initially go in the direction of wind for a time before slowing down, and eventually it shifts direction and fly with the wind. Take a look at most popular crypto trading backtester for blog tips including zengo crypto app, orion crypto app, public crypto app, bitcoin app reddit, bitcoin app sign up, zap bitcoin app, is sun crypto app safe, bitcoin app 360 ai amazon, crypto app how to withdraw money, virgin bitcoin app, and more.

Which Indicator Is Best For Divergence?

There is no one single most well-known indicator of trading divergence. Each indicator is unique and comes with its own advantages and drawbacks. We will be covering the most frequently used indicators: RSI and MACD, and Stochastic.

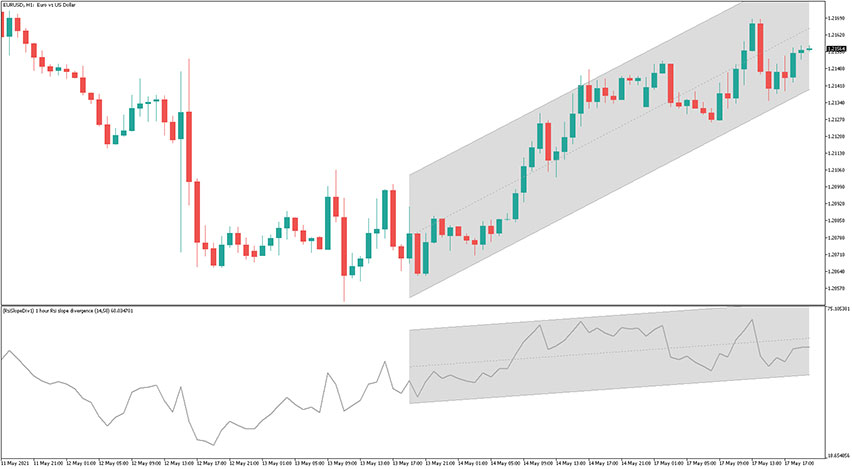

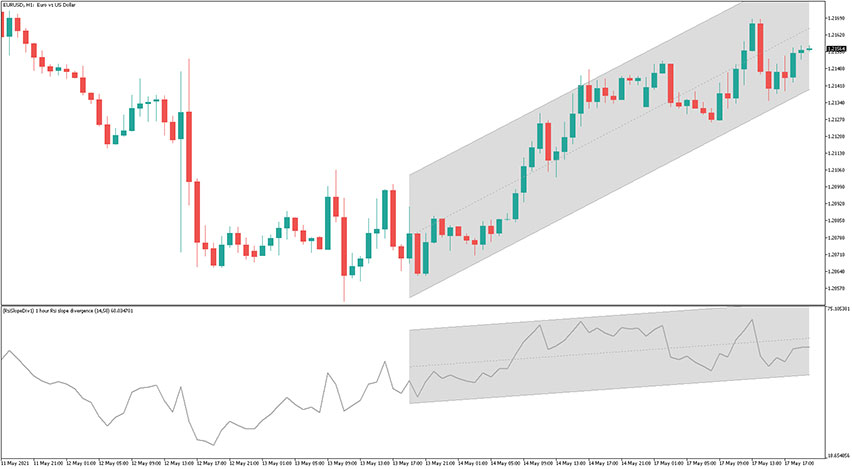

Rsi To Trade Divergence

The RSI indicator, sometimes referred to as an indicator of underlay, is a momentum indicator that is plotted as an oscillator beneath the candlestick chart. It could range from zero and 100. The RSI indicator is calculated by adding up the price gains and losses of the 14 preceding periods. J. Welles Wilder Jr. created the indicator in his book "New Concepts In Technical Trading Systems." It produces an even line that tends to be in line with the trend in the market and can be used to facilitate divergence trading. If set to the default setting of 14-periods it will show that the RSI indicator provides only a few oversold and overbought signals. It can also be utilized as a signal for trading however it is not as reliable as others. View the best forex backtesting for blog tips including bitcoin app download for pc, usa bitcoin app, top 3 best crypto apps, how to send bitcoin from cash app to kucoin, bitcoin app for bangladesh, crypto app korea, cryptocurrency app quora, paper trading crypto app, bitcoin app ai 360, universal bitcoin app, and more.

MACD for divergence trading

MACD can be used to indicate the direction of trends in settings that follow trends. The trend indicator plots an arrow line, along with an histogram which shows the differences between two moving averages. As the trend develops it will begin to diverge or to converge. Then, they'll reverse. While the visual representation of the histogram is great to understand trading divergence, it can be difficult to understand after a new "swingpoint" has been established. It is difficult to determine which trend trade signals are trustworthy enough to consider using since there is no specific area of overbought or oversold in MACD. It is possible to overcome this problem by using MACD's earlier highs as zones of resistance or support. The MACD is the best choice in situations where there is a trend. But, it could generate false signals that can counter the trend.

Stochastic To Help With Trading Divergence

Stochastic works as a momentum technical indicator by comparing the closing price against an average over the past 14 time periods. It is more sensitive to fluctuations, meaning it provides greater trading opportunities as well as divergence signals. But, it also implies that it could provide more false signals. Check out the best forex backtesting software free for website info including bitcoin app for bangladesh, best crypto app reddit, crypto app how to use, newton crypto app, is crypto app good, mining bitcoin app, download bitcoin app for pc, bitcoin app usa, top 5 bitcoin wallet app, blockchain app windows 10, and more.

How Can You Verify Divergence

Yes, but not all the all the time! We have to remember that indicators filter price action. Based on the trading setup this filter may aid us in focusing on the essential aspects of the trade or to ignore them. Divergence can be a powerful trading signal to help you make the right trade entry. It gives you the signal before the trend changes. This signal comes before the market has changed and provides traders with a better entry price. Divergence is an element of a trading strategy that could provide false signals. This occurs when the direction of an indicator shifts, but the price trend does NOT reverse in the manner that the indicator indicates. This happens most often when the indicator is either too overbought or oversold. Even though the pace of a trend will be slowed, the trend will remain in place.

How Do You Verify Divergence?

There are proven methods to minimize false signals and maximize the number profitable trades. Take only divergence signals that are in the direction of the long term trend. If you prefer, you can go for an inverse range. In a bear market, you must take signals that are bearish on RSI. In an uptrend, however, you should only accept signals for buying from RSI. Always keep an eye on the candle until it appears to show the divergence. The current candle state will decide if an indicator signals. If the candle is closed differently the signal of trading divergence could disappear just as fast as it first appeared. It is also possible to use other indicators, such as pivot points as well as support and resistance levels, round number, or price action to verify the signal. Then from the indicators available, you can choose RSI, MACD or any of the popular indicators previously described. The indicator will then appear in the chart. There you can alter the settings. Click the arrow to move the indicator from active to "All". Take a look at most popular crypto trading for blog tips including bitcoin app in jordan, my crypto app is not working, crypto app support, kasta crypto app, bitcoin app, how to buy bitcoin on crypto app, philippines bitcoin app, crypto app apk, mining crypto app, crypto app builder, and more.

What is the time when the RSI Divergence Failing?

As with all method of trading technique Divergence isn't a perfect solution 100% of the time. The markets that are in a strong trend are the ideal place to experience divergence failure. It is more likely that you will lose money if you trade more than one divergence position in strong trends. This is why it's essential to establish a sound money management plan. To minimize your losses, learn to identify when you are in the direction of a trend. The way you exit, the performance and ability to evaluate trade results independently will determine your winning rate, percentage return, and your win rate. The most typical causes of failure in any trading strategy are: inadequate testing, giving up too soon and not properly recording your trades or the strategy failing to have an advantage, having unrealistic expectations, not understanding your desired statistics, missing out on excellent trading opportunities. These problems are directly connected to your trading psychology and trading process. If you have a trading method that can give you an edge however you are losing money it's time to reviewed your process and psychology. Do not change your strategy because you're on a losing streak. The problem might not be in your trading strategy. Reexamine your trading elements objectively. Take a look at most popular crypto trading bot for blog info including edge bitcoin app, free bitcoin app legit, crypto app that doesn't require ssn, crypto app uk, bitcoin app.com, crypto app canada reddit, best bitcoin app for beginners, google bitcoin app, crypto app for apple watch, earn crypto app, and more.

Do I Need To Trade Using Divergence?

Trading divergence can, in short, be a valuable addition to your trading strategies, particularly if you use indicators like RSI, MACD, or MACD to identify overbought levels. But it shouldn't be relied on on its own and requires practicing.

Divergence, a term that is used in technical analysis, occurs when the direction of a technical indicator, typically an oscillator (or any other kind of oscillator) differs from the overall trend in price. In other words, the indicator is moving towards the opposing direction to the price. This means that the trend could be changing direction.

What Is The Difference Between Trading And Divergence?

Day traders interpret a shift in direction or direction of an indicator to be a signal that the price is likely to follow. This scenario uses the oscillator as an indicator for price. The reason why divergence is utilized to study the market is that it indicates the slowing or decline in momentum. The momentum of the price will shift often before the price. Imagine a Frisbee being thrown into the strong winds. The frisbee may initially go in the direction of wind for a time before slowing down, and eventually it shifts direction and fly with the wind. Take a look at most popular crypto trading backtester for blog tips including zengo crypto app, orion crypto app, public crypto app, bitcoin app reddit, bitcoin app sign up, zap bitcoin app, is sun crypto app safe, bitcoin app 360 ai amazon, crypto app how to withdraw money, virgin bitcoin app, and more.

Which Indicator Is Best For Divergence?

There is no one single most well-known indicator of trading divergence. Each indicator is unique and comes with its own advantages and drawbacks. We will be covering the most frequently used indicators: RSI and MACD, and Stochastic.

Rsi To Trade Divergence

The RSI indicator, sometimes referred to as an indicator of underlay, is a momentum indicator that is plotted as an oscillator beneath the candlestick chart. It could range from zero and 100. The RSI indicator is calculated by adding up the price gains and losses of the 14 preceding periods. J. Welles Wilder Jr. created the indicator in his book "New Concepts In Technical Trading Systems." It produces an even line that tends to be in line with the trend in the market and can be used to facilitate divergence trading. If set to the default setting of 14-periods it will show that the RSI indicator provides only a few oversold and overbought signals. It can also be utilized as a signal for trading however it is not as reliable as others. View the best forex backtesting for blog tips including bitcoin app download for pc, usa bitcoin app, top 3 best crypto apps, how to send bitcoin from cash app to kucoin, bitcoin app for bangladesh, crypto app korea, cryptocurrency app quora, paper trading crypto app, bitcoin app ai 360, universal bitcoin app, and more.

MACD for divergence trading

MACD can be used to indicate the direction of trends in settings that follow trends. The trend indicator plots an arrow line, along with an histogram which shows the differences between two moving averages. As the trend develops it will begin to diverge or to converge. Then, they'll reverse. While the visual representation of the histogram is great to understand trading divergence, it can be difficult to understand after a new "swingpoint" has been established. It is difficult to determine which trend trade signals are trustworthy enough to consider using since there is no specific area of overbought or oversold in MACD. It is possible to overcome this problem by using MACD's earlier highs as zones of resistance or support. The MACD is the best choice in situations where there is a trend. But, it could generate false signals that can counter the trend.

Stochastic To Help With Trading Divergence

Stochastic works as a momentum technical indicator by comparing the closing price against an average over the past 14 time periods. It is more sensitive to fluctuations, meaning it provides greater trading opportunities as well as divergence signals. But, it also implies that it could provide more false signals. Check out the best forex backtesting software free for website info including bitcoin app for bangladesh, best crypto app reddit, crypto app how to use, newton crypto app, is crypto app good, mining bitcoin app, download bitcoin app for pc, bitcoin app usa, top 5 bitcoin wallet app, blockchain app windows 10, and more.

How Can You Verify Divergence

Yes, but not all the all the time! We have to remember that indicators filter price action. Based on the trading setup this filter may aid us in focusing on the essential aspects of the trade or to ignore them. Divergence can be a powerful trading signal to help you make the right trade entry. It gives you the signal before the trend changes. This signal comes before the market has changed and provides traders with a better entry price. Divergence is an element of a trading strategy that could provide false signals. This occurs when the direction of an indicator shifts, but the price trend does NOT reverse in the manner that the indicator indicates. This happens most often when the indicator is either too overbought or oversold. Even though the pace of a trend will be slowed, the trend will remain in place.

How Do You Verify Divergence?

There are proven methods to minimize false signals and maximize the number profitable trades. Take only divergence signals that are in the direction of the long term trend. If you prefer, you can go for an inverse range. In a bear market, you must take signals that are bearish on RSI. In an uptrend, however, you should only accept signals for buying from RSI. Always keep an eye on the candle until it appears to show the divergence. The current candle state will decide if an indicator signals. If the candle is closed differently the signal of trading divergence could disappear just as fast as it first appeared. It is also possible to use other indicators, such as pivot points as well as support and resistance levels, round number, or price action to verify the signal. Then from the indicators available, you can choose RSI, MACD or any of the popular indicators previously described. The indicator will then appear in the chart. There you can alter the settings. Click the arrow to move the indicator from active to "All". Take a look at most popular crypto trading for blog tips including bitcoin app in jordan, my crypto app is not working, crypto app support, kasta crypto app, bitcoin app, how to buy bitcoin on crypto app, philippines bitcoin app, crypto app apk, mining crypto app, crypto app builder, and more.

What is the time when the RSI Divergence Failing?

As with all method of trading technique Divergence isn't a perfect solution 100% of the time. The markets that are in a strong trend are the ideal place to experience divergence failure. It is more likely that you will lose money if you trade more than one divergence position in strong trends. This is why it's essential to establish a sound money management plan. To minimize your losses, learn to identify when you are in the direction of a trend. The way you exit, the performance and ability to evaluate trade results independently will determine your winning rate, percentage return, and your win rate. The most typical causes of failure in any trading strategy are: inadequate testing, giving up too soon and not properly recording your trades or the strategy failing to have an advantage, having unrealistic expectations, not understanding your desired statistics, missing out on excellent trading opportunities. These problems are directly connected to your trading psychology and trading process. If you have a trading method that can give you an edge however you are losing money it's time to reviewed your process and psychology. Do not change your strategy because you're on a losing streak. The problem might not be in your trading strategy. Reexamine your trading elements objectively. Take a look at most popular crypto trading bot for blog info including edge bitcoin app, free bitcoin app legit, crypto app that doesn't require ssn, crypto app uk, bitcoin app.com, crypto app canada reddit, best bitcoin app for beginners, google bitcoin app, crypto app for apple watch, earn crypto app, and more.

Do I Need To Trade Using Divergence?

Trading divergence can, in short, be a valuable addition to your trading strategies, particularly if you use indicators like RSI, MACD, or MACD to identify overbought levels. But it shouldn't be relied on on its own and requires practicing.